Bracing for the Fall

by Brian Sokolowski, CFA

Bluebird Wealth Management

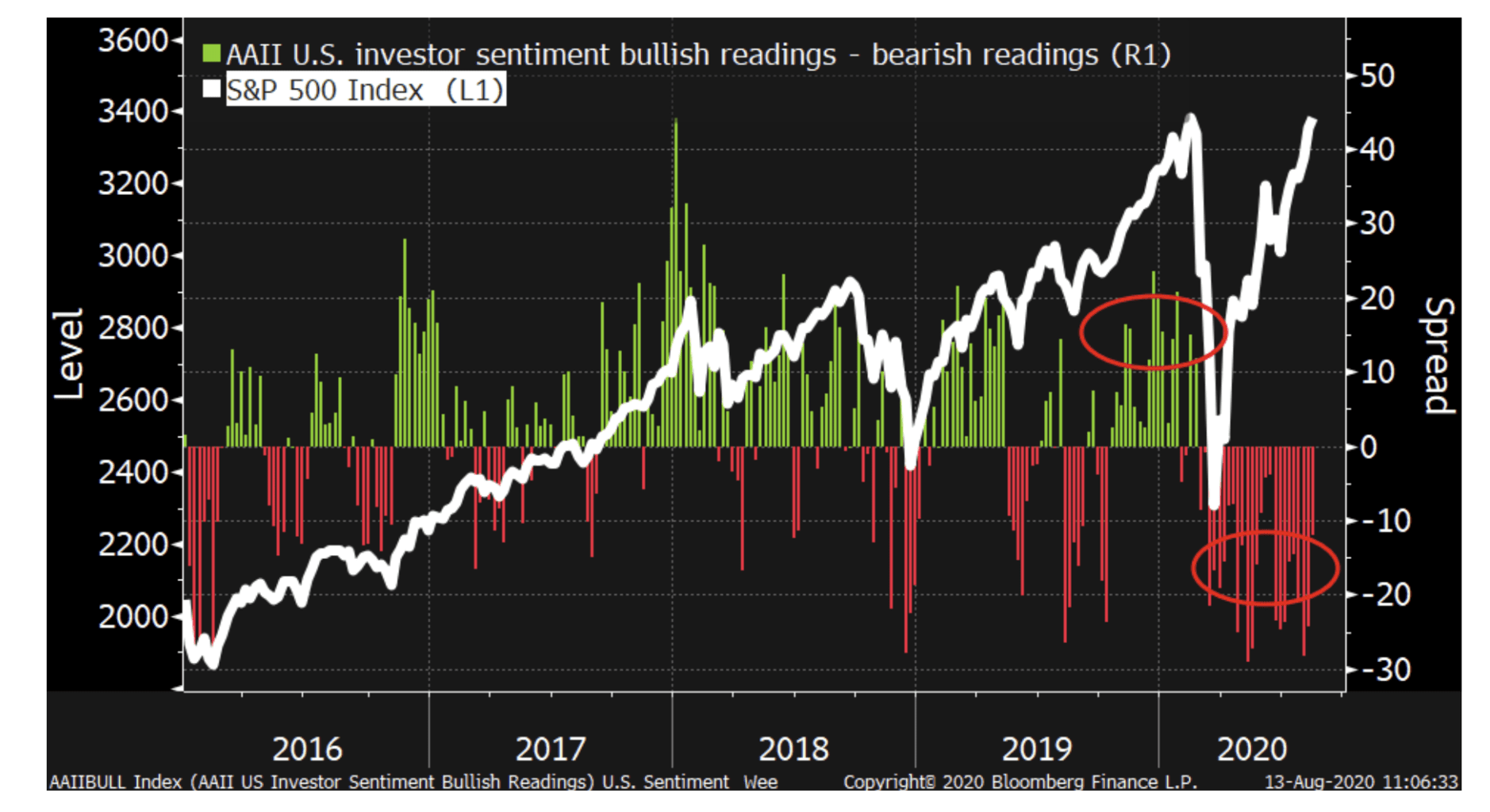

While “The Most Hated Stock Market Rally” was a common refrain over much of the 2009-2020 bull market, the remarkable rally off the March 2020 lows has truly earned the moniker, in our opinion. Investor sentiment always sours around market lows, but this time the details were indeed different as most of us have never endured a global pandemic, nor have we witnessed governments around the world voluntarily closing economies to address a public health crisis. These are truly uncharted waters. It is therefore understandable that many people found the notion that stock prices not only could stop going down but could rally unbelievable.

As a mentor and former colleague reminded me in recent months “the market has a way of causing the greatest amount pain to the largest number of people” – a quote which has found a permanent home on my office whiteboard. With the S&P 500 hovering around flat for the year, and up ~50% from the lows, the “easy money” (which is never so easy) has been made and many investors are very concerned about events in the autumn. We are concerned too, although as a preview of our conclusion perhaps a more accurate title for this note would be “Bracing for Autumn”.

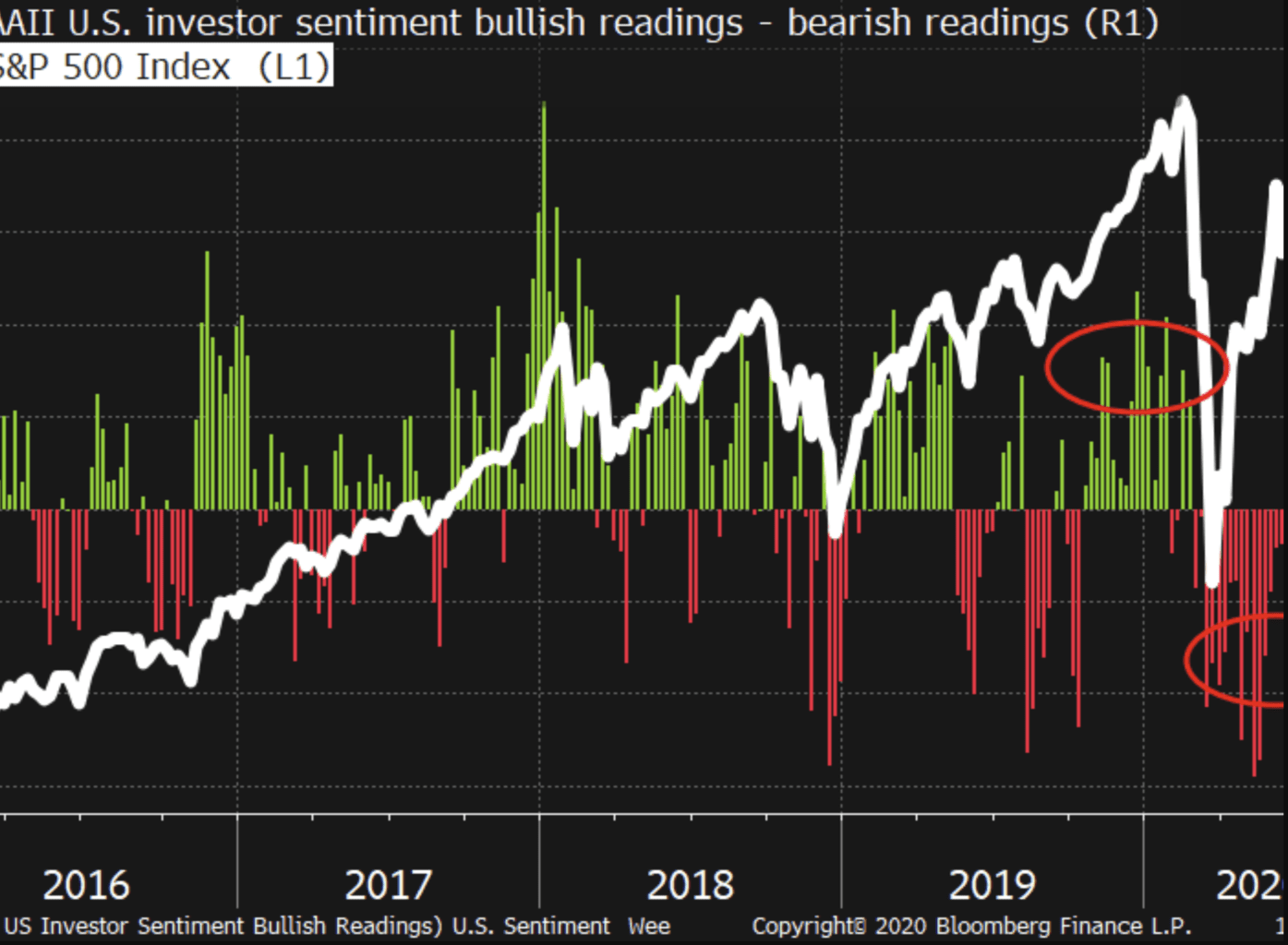

Investor sentiment versus S&P 500 (Source: Bloomberg)

Green bars indicate net investor bullish readings, red bars indicate bearish readings. Note the bars relative to forward S&P 500 returns in 2020.

COVID 19

There are two major areas of focus regarding COVID-19 as summer ends: key results for several vaccines (as well as treatments), and a long-feared resurgence of the virus in the fall.

Vaccines

The vaccine development news appears positive and expectations are increasing that clarity around a timeline for vaccine(s) approval will be announced by the end of 2020. We think this is a reasonable expectation, but also recognize the meaningful risk to stock prices if the recent positive vaccine news trend were to reverse and begin to disappoint. It would take multiple vaccine efforts to fail for this to occur, which we view as a low probability event. The market consensus also views this as a very low probability event, which is why we view multiple late-stage vaccine failures as a major (although unlikely) risk over coming months.

What would be the impact of vaccine failures on economic activity? We could see the case for a near-term increase in economic activity if it were to become clear that the search for a vaccine is a multi-year event as opposed to a 12-month event. Behavior and policy now and into the fall are in many cases predicated on the assumption that a vaccine will be available to our most vulnerable population by the first half of 2021. If vaccine expectations were to shift to a multi-year event, we believe near-term behavior would begin to normalize faster as society prepares to deal with a longer fight. In this scenario, an ultimate return to pre-pandemic levels of economic activity would take longer, but we would expect a near-term increase in activity.

Case Surge

Even before the virus’ resurgence across the US in recent months, the path of public health in the fall was a significant concern due to colder weather, annual flu season, more employees returning to work, and a potential return to school. The summer surge in cases across a large portion of the US has had a few impacts:

Tempered some of the most optimistic forecasts regarding the pace of reopening. For example, after a furious rally off the March lows, stocks levered to a re-opening economy such as airlines, restaurants, and casinos are well off early June highs as cases have surged.

Pulled forward and spread out the concern about the path of cases in the fall.

Flattened the economic recovery path – rather than a sharp summer rebound followed by a likely dip in the fall, the more likely scenario is now a continued gradual economic recovery.

We are also encouraged by the only-mild resurgence of the virus in prior US hotspots, such as the Northeast, despite the significant increase in mobility and relaxation of distancing behavior in recent months. For example, the positive test rate remains around 2% in Massachusetts despite a significant increase in traffic in recent months. Whether these trends are driven by behavior and policy (masking and distancing) or potentially by encouraging factors related to lower thresholds for community immunity or natural human defenses (as addressed in this interesting New York Magazine article), we would expect these factors to remain in place into the fall and therefore are more sanguine on the severity of a potential surge than many observers.

To be clear, vaccines (along with a potential breakthrough treatment) would be unequivocally good news for society, the economy, and the stock market. However, even without a vaccine, we believe the low point in economic activity is in the rear-view mirror. While the cause of this recession is different than all other US recessions in our lifetime, and the speed of the drop was astounding, recessions still typically follow patterns – stock prices drop ahead of declining economic activity, and then begin to rebound during the recession. While there has appeared to be an enormous chasm the last four months between strong stock prices and an awful economic reality, the pattern is fairly normal – economic activity likely bottomed extremely quickly during this recession and while the timing of a return to prior levels remains in question we are confident the economic bottom is behind us. For example, TSA Checkpoint data indicates air travel bottomed at -95% from pre-pandemic levels but has recovered to -65% from pre-pandemic over the last six weeks. While there remains a long way to go for this measure to return to normal, we do not believe there is enough public support to return to widespread lockdowns, giving us confidence in continued improvement in economic data.

US Elections

The country is bracing for November US election results, investors included. Polling consensus indicates a Biden victory in the presidential race, and although we are reminded of late come-from-behind victories (Bush over Dukakis in 1988) or narrow, low-probability electoral college victories (Trump 2016), 2020 appears as if it is Biden’s election to lose at this point. The main risk to this guess is the potential for lopsided debate victories for President Trump.

Would a Biden victory be a big negative for stock prices? No, not in our opinion. Certain sectors will benefit or face higher risks, which will become clearer as we get closer to November. While a Biden administration would likely be less business friendly, we would also expect more steady and consistent messaging and policy as compared to the current administration. Investors appreciate consistency and clarity. We also have a general view that investors/financial media often overestimate the importance of presidential elections on the stock market, particularly over the long- term.

One area that the market has not yet fully priced the risk is in the potential for a Democratic sweep (House, Senate, and President), where we do see the possibility of meaningful change which could have a significant near-term impact on stock prices and long-term impact on certain sectors or companies. Controlling both houses of Congress and the Executive Branch increases the risk of meaningful policy change. As mentioned above, investors are generally averse to large changes, particularly if those changes are in the direction of higher taxes and greater regulation. What are the chances for a Democratic sweep? Although imperfect, handicapping website Predict It currently places the probability at 54%. We will be closely watching individual Senate races in coming months, as will the market.

Compounding the risk of significant policy change this cycle is the potential for rule changes in the Senate. The Senate filibuster has historically acted as a governor on the rate of policy change, and speculation is increasing that a Democratic majority in the Senate may eliminate the filibuster, clearing the way for large structural changes across the US economy, such as: breaking up technology firms, price controls in healthcare, significant financial and regulatory overhauls, and more as outlined in this Washington Post article. A one-party sweep and removal of the filibuster is the market risk which concerns us the most as November approaches.

What have we been doing in client portfolios?

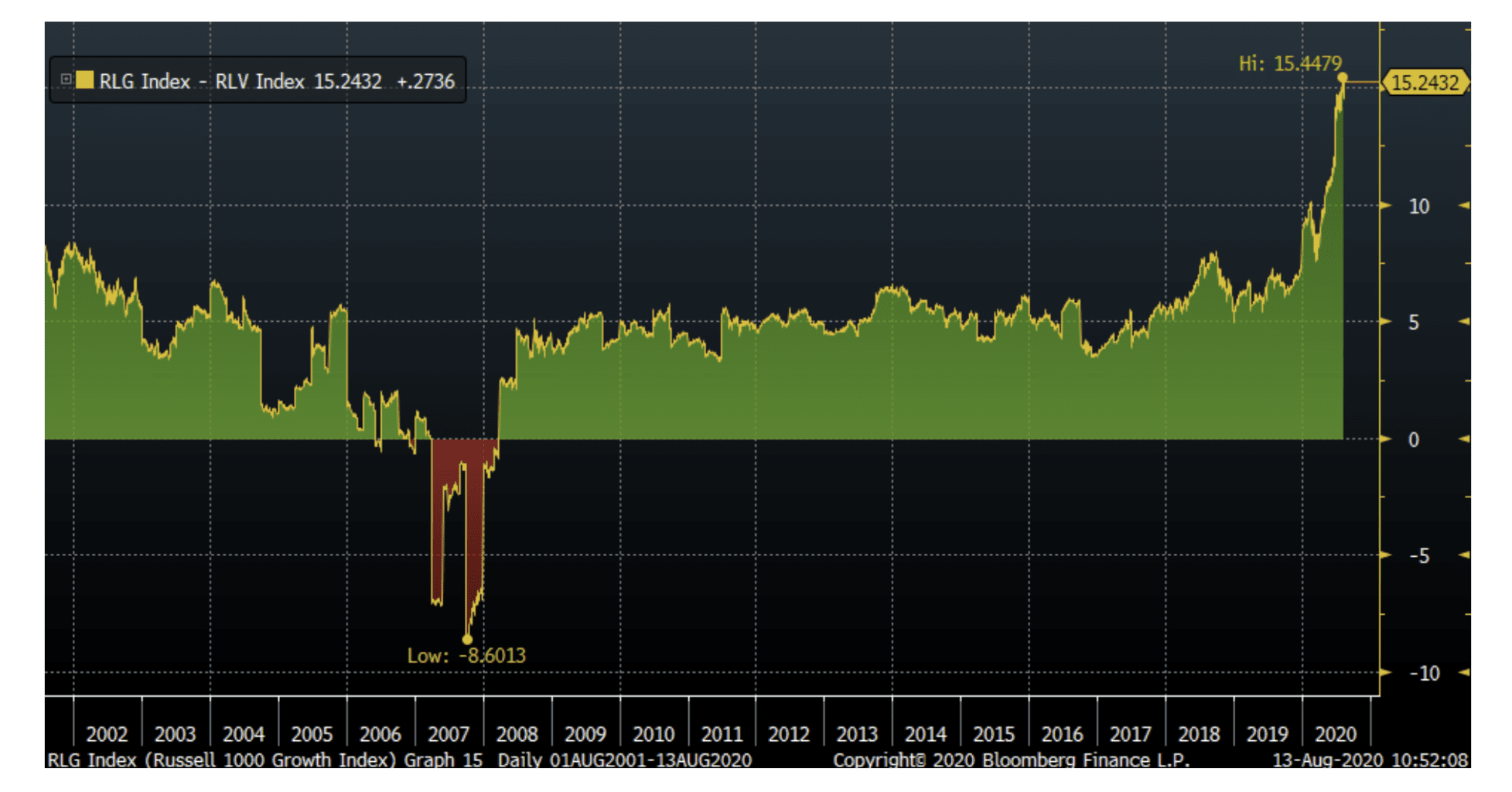

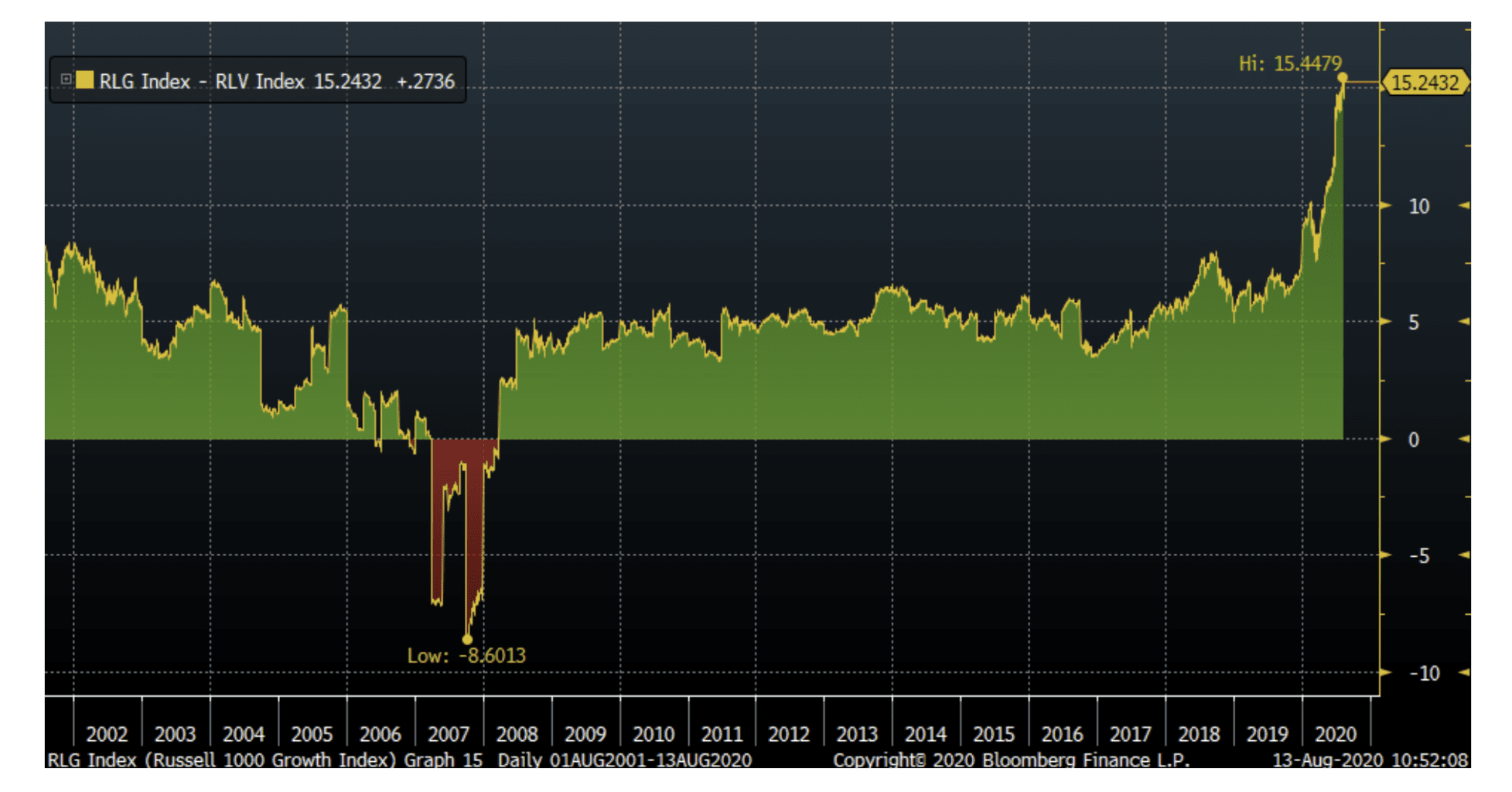

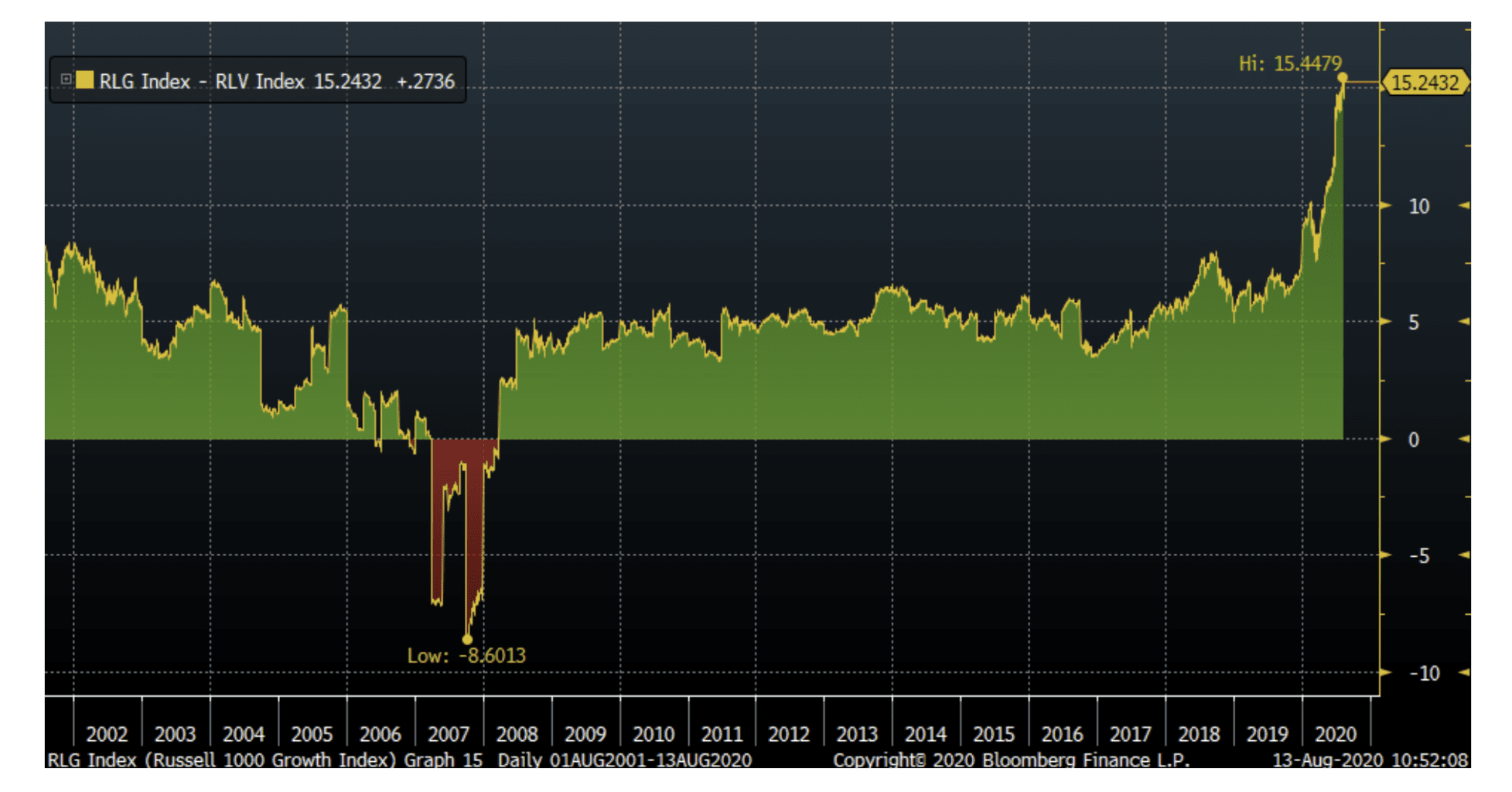

Within equities, we have been overweight growth stocks throughout the year, and are remaining so. We have taken opportunities to modestly reduce position sizes in some of the biggest winners in the technology/growth areas to control portfolio risk, and have cautiously redeployed these funds in certain cyclical stocks which remain well off their pre-pandemic highs, such as: aerospace, industrials, travel, and entertainment. Most client equity portfolios remain overweight growth stocks, although less so than earlier this year. We are constantly balancing our core competency of owning Quality Growth companies for long periods of time, with valuation discrepancies within equities (the current extreme valuation premium present in growth stocks compared to value stocks, chart below).

Price-to-cash flow premium (discount) of the Russell 1000 Growth Index versus the Russell 1000 Value Index (Source: Bloomberg)

Within fixed income, we found significant opportunity in corporate credit during the March panic, when we were able to meaningfully increase yields by slightly extending duration while taking on acceptable levels of credit risk. This window slammed shut quickly as the Federal Reserve signaled its willingness to support the riskiest parts of the corporate credit market. We are currently finding opportunities in lower-rated municipal bonds (A), although often for good reason as many of these bonds are supported by areas currently under pressure, such as travel infrastructure or university housing revenue. We also continue to advocate replacing a portion of one’s bond allocation with dividend-growth stocks, as long as the near-term cash flow needs of the portfolio are modest enough to withstand the higher volatility of equities relative to bonds. For example, the current yield to maturity on a 5-year Johnson and Johnson bond is 0.50% per year, whereas JNJ stock’s dividend yield is 2.8% per year, with the additional potential for price appreciation.

To summarize, while we acknowledge the risk to the market given the huge run off the March 23 lows and the twin issues of the autumn, we remain generally positive on equities given our view that the economic risk from COVID is skewed positively (big upside from vaccine/treatment vs. modest economic downside from current levels on lack of medical breakthroughs), and long-term impact from most political developments is often overstated. We view one-party rule with elimination of the filibuster as the largest market risk in coming months, especially the impact this development could have on corporate taxes and the regulatory pressure on portions of the economy and market. Finally, we take seriously the potential for a disputed election and the subsequent uncertainty as the results are settled. While we will continue to monitor and, where prudent, adjust portfolios for these risks, we close with a quote from legendary investor Peter Lynch:

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Bluebird Wealth Management, LLC

Medfield Office

(508) 359-4349

266 Main St.

Suite 19B

Medfield, MA 02052

West Newbury Office

(978) 775-1287

6 Felton Ln.

West Newbury, MA 01985

We serve individuals and families throughout the United States.

Bluebird Wealth Management, LLC

Medfield, MA Office

266 Main St.

Suite 19B

Medfield, MA 02052

+1 (508) 359-4349

info@bluebirdwealthmanagement.com

West Newbury, MA Office

6 Felton Ln.

West Newbury, MA 01985

+1 (978) 775-1287

info@bluebirdwealthmanagement.com

We serve individuals and families throughout the United States.