Goldilocks’ Wish List

by Brian Sokolowski, CFA

Bluebird Wealth Management

Although it is a popular metaphor in the investment commentary business, especially in recent years, referencing Goldilocks seems particularly apt as we assess recent months and the current situation in markets. It is fitting that the great Goldilocks Bull Market which began in 2009 gets one more thrust from the recent “just right” mix of economic and market conditions.

As measured by the S&P 500, US stocks reached new all-time highs this week, only 80 days after a 20% correction in the S&P 500. This quick turnaround has left many investors perplexed and concerned that this is a fleeting rally, only to soon fail and head back towards the lows of December. While we have certainly been impressed with the speed of the market recovery, and do not know how long the current just right conditions will hold, we think the Goldilocks prism is a helpful way to view the recent rally.

Economic factors are at the top of Goldilocks’ list:

1. At the top of the list is the Federal Reserve and its extremely rapid change in policy late last fall when it became apparent that global economic growth was slowing. Perhaps relatively new Chairman Powell had became a bit too relaxed with his commentary through 2018 (specifically his October comments that the balance sheet unwind was on “autopilot” and short term interest rates were “well below neutral”), but his relatively quick reversal by December to loosen monetary conditions by pausing short term interest rate increases and slow the balance sheet unwind appears to have been the correct move, because:

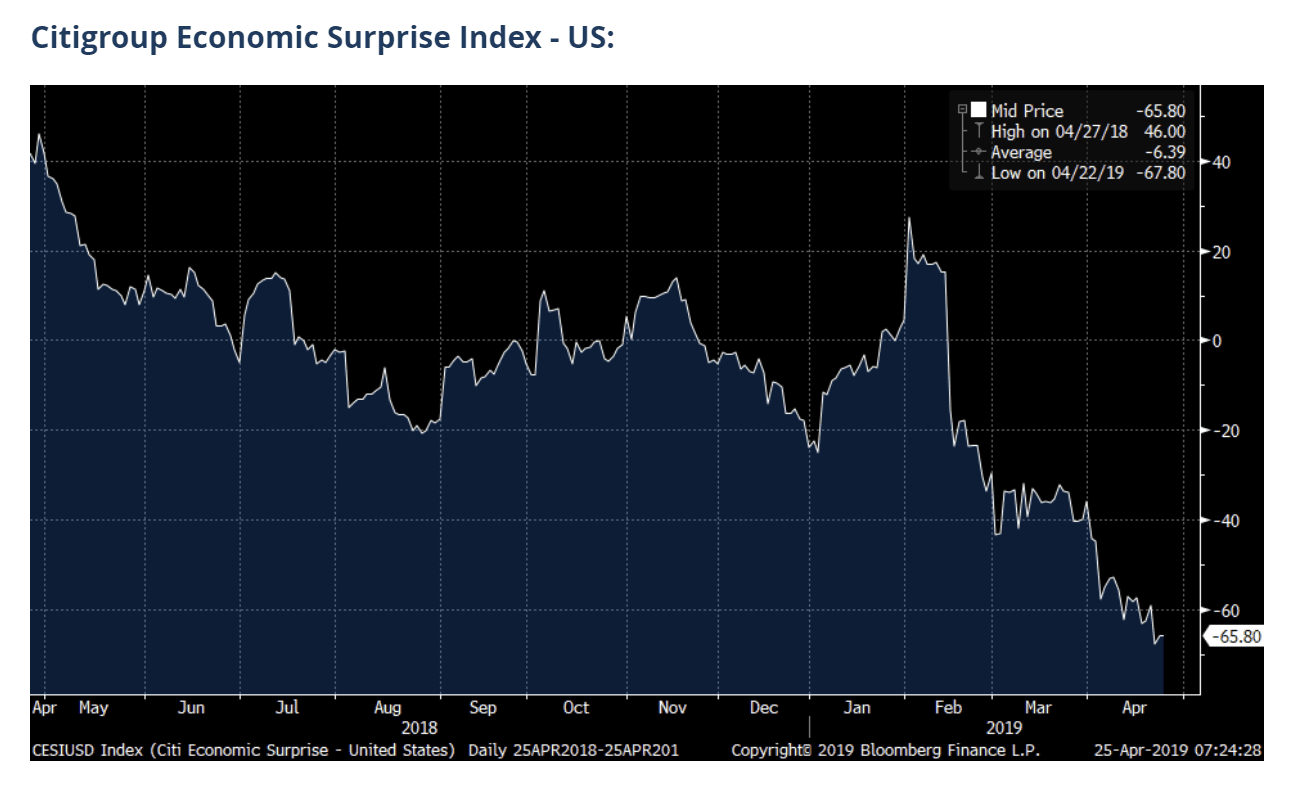

2. Growth has indeed slowed, both internationally and in the US. China data has been disappointing since early 2018, and accompanied by a Chinese equity bear market last year. There were early signs of deterioration in forward looking indicators in the US in the fall of 2018, which have become widely evident early in 2019. Disappointing economic growth in the world’s two largest economies is apparent in the Citigroup Economic Surprise Indexes for the US and China (see charts below). Chinese data began surprising to the upside again recently, as stimulus measures by the government are generally quick to take hold (but can also reverse course quickly). US data has continued to disappoint, but we believe the change in Fed positioning will lead to at least a modest pickup in US economic activity as we move through 2019.

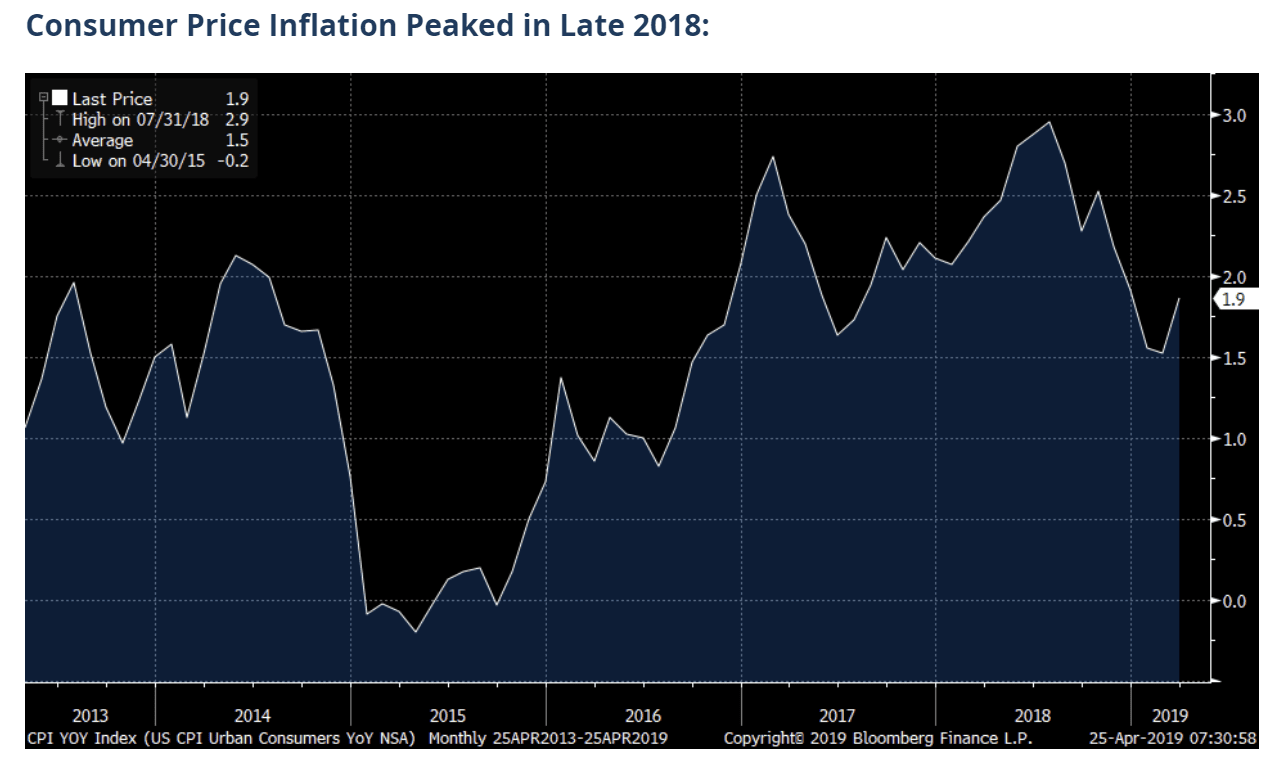

3. Politics aside, President Trump’s trade disputes have helped to tap the brakes on the two major global economies precisely when inflation was becoming a significant global risk. We wrote last summer that our biggest concern was an overheating of the US economy which would be evident in inflationary pressures and would need to be curtailed by the Fed. Uncertainties caused by the trade dispute dampened economic activity just enough to slow inflation (see chart below), giving the Fed the ammunition to pause its tightening program and begin to loosen policy on the margin.

There are a number of market items on her list as well:

4. The by-product of the softer economic growth discussed above is a slowdown in corporate earnings growth. Consensus estimates for the S&P 500 were for slightly down earnings in the first quarter compared to 2018, and for very modest growth in the second quarter. Over recent months earnings growth expectations were reset for 2019, particularly for the first half of the year, and the lower bars have been easier for companies to clear. Lower earnings expectations are clearly a negative, but this was reflected in the sharp 2018 selloff. We argued a few months ago that corporate management teams had every incentive to give conservative outlooks for 2019, and we continue to believe conditions are ripe for an upward-estimate-revision, beat-and-raise year for many companies.

5. Selectivity is a sign of a healthy market. There are multiple signs of selectivity on the part of investors, including:

-According to Citigroup data, correlation between equities has fallen dramatically in recent months (following an increase in the market collapse and rally, which is common), indicating selectivity on the part of investors, rather than blanket buying.

-We have also seen selectivity in post-IPO stock performance. For example, the much-hyped IPO of Lyft has experienced very weak performance, while under the radar IPOs such as Zoom and Pagerduty have experienced very strong returns.

-While the market as measured by the S&P 500 recently surpassed its prior highs, only one of the FAANG stocks (Alphabet) has reached new highs.

6. While the Equity Risk Premium (the difference in expected returns for stocks versus long term Treasury bonds) has declined since the market lows, low bond yields result in stocks still appearing very attractive compared to bonds. One area this is evident is in the high percentage of stocks which are yielding more than the 10 Year Treasury. In early April 41% of S&P 500 stocks carried a dividend yield above the 10 Year Treasury, up from 30% in late summer 2018, according to Strategas Research.

7. Even in the context of what has been characterized as a widely disliked 9+ year bull market, investors seem especially cautious in regards to the 2019 rally, which is a positive. The term “re-test” is making regular appearances in quarterly investment letters and in the investment media, with many calling for the market to trade back towards December lows. Sentiment indices such as the AAII US Investor Sentiment Bullish Readings and the Investors Intelligence Bull/Bear Ratio remain muted despite the very strong first quarter returns. Anecdotally, the Chief Investment Officer of a large Canadian wealth management firm was on financial media this week lamenting that the historic (in length) bull market has outpaced the relatively tepid economic recovery as measured by GDP growth. He is missing the point that stock market returns and GDP are only loosely correlated and, more importantly, the tepid nature of this recovery is exactly the reason for the length of the bull market in stocks (Goldilocks)!

We usually don’t get everything on our wish list, and this is true for Goldilocks as well:

While the overall market valuation is reasonable or average, certain important sectors or factors are getting pricey. The market leader this year is Technology, which is now trading at a multi-year high valuation of 19.4x forward earnings estimates. Similarly, growth has continued to lead value resulting in a 35% valuation discount in value stocks as compared to growth stocks, which is the lowest level in more than a decade, according to Russell data.Many of the items on the wish list are dependent upon other factors, including:While equity valuations are average historically on an absolute basis, they are attractive relative to bonds. If bond yields were to increase significantly, this relative advantage would decrease. While the Fed is on hold for now, if economic growth were to accelerate an increase in inflation would likely follow (it has already perked up again following the decrease in fall 2018, see chart above), and Fed policy tightening would be back on the table. We don’t necessarily expect this to be a major negative, but it would require an adjustment for the market.Most importantly, US economic data has yet to meaningfully improve following the slowdown which began late last year. There have been some signs of improvement in leading indicators such as building permits, consumer confidence readings, and housing starts but a return to growth is far from assured at this point.

Outlook and Positioning

Given the balance of the above, we think there was sufficient support for the recent rally. We see modest upside potential to growth expectations through the balance of the year, leaving the market on decent footing as we move through 2019. Current market expectations are for the next Fed funds move to be a rate cut later this year, as opposed to a rate increase. We think these expectations will change, and potential Fed tightening will again be on the table, but the Fed will take its time and allow inflation to begin to run slightly hot before acting. The current growth and earnings slowdown may be once again breathing life and length into this economic expansion (with a big assist by the Fed), which is a positive for equity markets.

Given our outlook at the time and the extremely cheap valuations in late 2018, our move to increase equity exposure during the pullback has paid handsomely, and despite the very strong run in equities we are maintaining our overweight position relative to targets (while expecting much more muted returns for the remainder of 2019 as compared to the first quarter) . Recently we have been modestly trimming exposure to some of our favorite groups (namely software and semiconductors) as the stocks have been huge winners and valuations are looking stretched, even with strong growth expectations. We have been rotating some of these proceeds into value areas, such as banks, which should benefit as interest rates again begin to gradually creep higher, and select international stocks. We are also finding opportunities in very high quality moderate-growth companies trading at discounted valuations (for example, a large media/entertainment company where our concerns around structural challenges are decreasing). We continue to favor some level of exposure to high yield equities (particularly telecom) in the place of bonds due to meaningfully higher dividend yields and the opportunity for modest price appreciation.

I look forward to your questions or comments.

Disclaimer: This publication is the opinion of Bluebird Wealth Management LLC and is for informational purposes only. It should not be considered investment advice or a recommendation of any investment strategy or security. These opinions are subject to change at any time based upon future events or market conditions.

Bluebird Wealth Management, LLC

Medfield Office

(508) 359-4349

266 Main St.

Suite 19B

Medfield, MA 02052

West Newbury Office

(978) 775-1287

6 Felton Ln.

West Newbury, MA 01985

We serve individuals and families throughout the United States.

Bluebird Wealth Management, LLC

Medfield, MA Office

266 Main St.

Suite 19B

Medfield, MA 02052

+1 (508) 359-4349

info@bluebirdwealthmanagement.com

West Newbury, MA Office

6 Felton Ln.

West Newbury, MA 01985

+1 (978) 775-1287

info@bluebirdwealthmanagement.com

We serve individuals and families throughout the United States.